HOME > Football

Does "Evergrande in the Car Circle" exist?

11:20pm, 31 May 2025【Football】

The hottest topic recently discussed is that there is a saying that there is a potential crisis like "Evergrande" on the automobile track.

Although there is no specific direction, since the public has a deep understanding of the two words "Evergrande" and the bankruptcy of Evergrande has a great impact on society, "Evergrande in the car circle" is indeed a word that quickly captures people's curiosity and attracts people's attention. It is not surprising that it can cause heated discussions across the Internet.

But I think it is worth pondering whether Evergrande exists in the car circle.

Let's first review what "Evergrande" is and how it went bankrupt:

Evergrande Group is an enterprise with real estate business as its main business. It also explores many other fields, such as football, drinking water, etc., but its most fundamental business is real estate, and the explosion is largely caused by the main business. The collapse of Evergrande Group is essentially a systemic risk caused by the superposition of multiple structural contradictions. The core reasons can be summarized into the following points:

1. High leverage and debt structure imbalance

Evergrande has long relied on bank loans, off-balance sheet financing (such as ABS, commercial paper) and equity financing, with a debt ratio of up to 1966.534 billion to 2.4 trillion. Its debt structure is mainly short-term liquid liabilities, and the scale of off-balance sheet debt is huge (estimated to 1 trillion), making it difficult to sustain the "borrow new and repay old" model. After the "three red lines" policy in 2020 restricted bank financing, Evergrande fell into a liquidity crisis, and debt default became inevitable.

Is there a high leverage and debt structure like Evergrande in the automotive field?

does exist. At present, the debt ratio of car companies is relatively high. For example, Ford's debt in 2024 was as high as 84.27%, and Volkswagen's debt ratio is also 68.54. Most car companies are in a state of high leverage and high debt operation. This is also why many people agree with the concept of "Evergrande in the car circle".

But debts and debts are also different. There is a concept mentioned many times on the Internet, that is, interest-bearing liabilities and interest-free liabilities should be viewed separately. Most of Evergrande's debts are interest-bearing liabilities (or they will not go bankrupt). Many car companies rely on their leading advantages to use their bargaining power to obtain a long account period. This type of liability is interest-free liabilities. For car companies, as long as the car can be sold, this kind of liability will not pose any burden to the company.

2. Blind expansion and diversification failure

Evergrande has transformed from real estate to "diversified industries + digital technology", and has involved in football, automobiles, health, culture and tourism, but most businesses have not formed a profit model, but have increased their debt burden. For example, Evergrande Auto and Health sectors suffered serious losses, with a loss of 812 billion in 2021. This "high leverage + high turnover" model collapsed rapidly when policies tightened and markets cooled down. Is there any case of blind expansion and diversification like Evergrande in the automotive field?

does exist, but car companies that blindly expand and diversify have basically gone bankrupt long ago.

You can directly name one here, which is Evergrande itself. Evergrande Group cross-border car manufacturing using the real estate model, and is accused of "making money out of nothing". Its diversification strategy (such as the layout of the entire industrial chain) has caused financial risks. Although Evergrande is not a traditional car company, its cross-border expansion model has been widely discussed.

LeTV Auto is half a piece, but it is also caused by LeTV's own blind expansion and diversification, rather than LeTV Auto's blind expansion and diversification.

Other car companies basically focus on their main business, and there is almost no news about "blind expansion" and "blind diversification".

3. Financial fraud and governance failure

Evergrande covers up debt risks through pre-sale funds misappropriation, false sales data, off-balance sheet financing, etc., and even "Ponzi dividends" (such as dividends exceeding 50 billion to shareholders in 2015). Internal management chaos, talent loss and excessive executive splurge have further exacerbated the financial crisis. The 2021 audit showed that Evergrande lost 812 billion yuan from 2021 to 2022, which is a huge difference from its previous financial report.

Are there any cases of financial fraud and governance failure like Evergrande in the automotive field?

Currently, most vehicle companies are listed companies, and sales data are generally reflected by insurance coverage. In addition, there is no "car futures" in the automotive industry. At most, companies charge a large 5,000 yuan fixed deposit. In addition to creating momentum, it has little significance and will also disrupt their own price system. After delivery for a period of time, the fraud will be exposed.

If you use the 0-kilometer used cars to sell cars, you will find that many brands have them on the used cars APP, but they are not large in scale. Generally, measures taken to increase sales at the end of a certain quarter, and consumers also get a certain amount of benefits when buying these cars. If a large-scale fraud is carried out through the 0-kilometer second-hand car, the price of the car in the market will plummet immediately. With the forwarding of many large and small car dealers, the public will immediately know that a car company has undergone large-scale fraud, which is completely different from a house.

And only when the car arrives at the store and enters the delivery stage, consumers will pay the entire car payment. Except for the situation where some 4S stores withhold certificates of conformity due to loans, the risk is very low for ordinary consumers.

4. External policies and market environment impact

The national "housing for living, not for speculation" policy and real estate tax pilot compressed Evergrande's financing space, and combined with the decline in sales caused by the epidemic, it directly hit its cash flow. After the implementation of the "Three Red Lines" policy in September 2020, Evergrande was unable to expand through bank financing and was forced to sell assets at a discount, but the collapse of market confidence led to further deterioration in sales.

Are there cases in the automotive field where Evergrande encounters impacts on external policies and market environment?

hardly exists.

In the domestic market, support and consumption subsidies are still the main focus. External policies are very "friendly". In terms of market environment impact, it is more of the impact of new energy vehicles on old fuel vehicles and the impact of smart cars on non-smart cars.

In the foreign market, many car companies have made good progress in going overseas. Although they will encounter various problems in the foreign local market, most of them can be overcome. Moreover, the quality and intelligence of domestic cars have reached a leading level, which is also very popular among overseas consumers, and the impact of the market environment only exists in some countries.

Therefore, under the policy and market environment, there is no "Evergrande in the car circle".

Conclusion

The essence of Evergrande's bankruptcy is the result of the joint effect of unsustainable expansion model driven by high leverage and the dual squeeze of policy regulation and market environment changes. Its failure not only stems from the corporate governance shortcomings, but also reflects the systemic risks of China's real estate industry under the dependence of financialization and leverage paths.

The current situation of domestic car companies is completely different from Evergrande, and there is no so-called "Evergrande in the car circle".

7m bong daRelated Posts

- Marca: Real Madrid youth training star Ferran Seco performed well and the club plans to renew the player s contract

- At the age of 16, he played 4 games in the U20 World Youth Championship with 3 goals and 2 assists. AS: The Mexican genius G-Mora is a dreamer of becoming an emperor.

- 2-1, one person wins, 10 players are third in Serie A, overturns first in Serie A, AC Milan wins 4 consecutive wins

- Morning Post: Arsenal s passionate victory over Newcastle, Barcelona reverses to the top, Milan defeats Naples to the top

- Joan Armeni: I m very satisfied with Alonso, he and Ancelotti are both great coaches

- Preview of the lottery event on September 7: World-European Preliminary Luxembourg vs Slovakia Belgium vs Kazakhstan

- Today s football two-string: Genoa vs. Juventus + Vallecano vs. Barcelona

- About Yamal, only Frick in Barcelona can suppress him, don t let him follow Neymar s footsteps

- 1-1! Controversy: Push the opponent away and scores the first goal + the captain kicks the penalty kick. The 890 million-dollar giants escaped from the relegation zone

- Desky: Eber is still working hard to make the Nkunku deal, but it is already very difficult

Hot Posts

- Marca: Real Madrid youth training star Ferran Seco performed well and the club plans to renew the player s contract

- At the age of 16, he played 4 games in the U20 World Youth Championship with 3 goals and 2 assists. AS: The Mexican genius G-Mora is a dreamer of becoming an emperor.

- 2-1, one person wins, 10 players are third in Serie A, overturns first in Serie A, AC Milan wins 4 consecutive wins

- Morning Post: Arsenal s passionate victory over Newcastle, Barcelona reverses to the top, Milan defeats Naples to the top

Recommend

Issue 25079: Kawasaki forward continues to rebound, Yokohama Mariners are still in a downturn

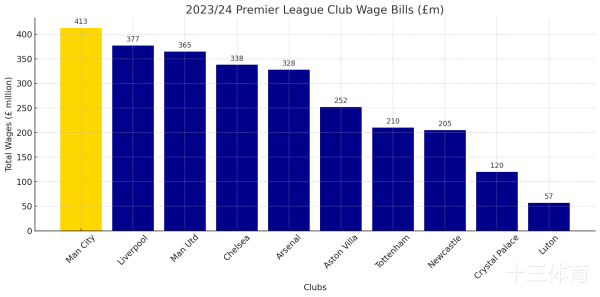

From 2.9 billion to 4 billion: Premier League wages soared by 38% in six years, is the salary bubble still rising?

The first round of the Premier League giants are mixed, Manchester City leads the lead 4-0, and lack of cooperation is a hidden danger

Reality is very skinny! The old master is powerless, Miami cannot escape, Messi can win if he can score a goal

Martin Keeon supports Tottenham Hotspur defeating Manchester United in UEFA Cup final

The team said goodbye! 37-year-old former Liverpool player Larana announced his retirement, ending his 19-year career

Dortmund official: Become the first German team to issue a sustainable development statement based on CSRD

August 8, 2025 Football Analysis [Xiaoyu Exclusive]